Crypto Rally Over For Now?

- Connie Chan

- Aug 16, 2022

- 2 min read

With bitcoin being rejected once again from the $24,400 resistance level, and ethereum enduring the same fortune from the $2,000 resistance, it does look as though the current crypto rally has possibly run out of steam for the time being.

The crypto rally out of an extremely severe downturn has been a very welcome relief for many holders of cryptocurrencies. From the very top in late November last year, crypto has dumped hard with the exception of a rally between the end of January and into April.

When bitcoin reached a bottom of $17,500 it seemed as though the price was never going to stop going down. Some commentators suggested that true capitulation was never reached, but from a technical analysis perspective the price had reached an extremely oversold level.

$17,500 did turn out to be a bottom. Whether this is just a local bottom, or whether the price might go down even further is yet to become apparent.

However, all good things generally come to an end, and it might be argued that the current rally has run its course. On the daily and weekly timeframes for bitcoin the Stochastic RSI is topping out, pointing to an overbought situation.

Bitcoin has been climbing higher within the confines of an upward-rising wedge, and this is a strong bearish pattern. From a TA perspective, there is a far more likely scenario that bitcoin breaks down out of the pattern. Should such a scenario unfold, then bitcoin could well revisit the $17,500 low.

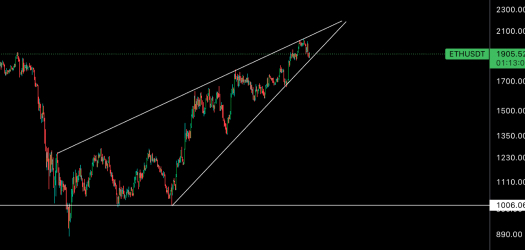

Ethereum, which is seen as the cryptocurrency that has most contributed to driving the entire crypto market higher, given the impending proof-of-stake merge in September, is in a similar situation to that of bitcoin.

The number 2 ranked cryptocurrency is also in a rising wedge, and the price is closing in towards the point of the wedge, which could continue over the next week or so before breaking in either direction.

It might be imagined that both bitcoin and ethereum break down soon and bring the rest of the crypto market with them. However, we all know that the market will take the path that is least expected.

More price action needs to unfold before we know whether the pull-back is just that, or whether it turns into a full-scale reversal. Nevertheless, even if a big reversal does take place, look for bitcoin and ethereum to come back strongly given the lack of options in most other asset classes.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Comments