Jim Cramer Says You Shouldn’t Borrow Money To Buy Bitcoin, Here’s Why

- David Manion

- Jun 10, 2022

- 3 min read

The issue of borrowing money in order to invest in cryptocurrencies such as Bitcoin has been a prevalent one in the crypto space. Mostly, there has been numerous news regarding individuals who borrowed money to purchase these cryptocurrencies and ended up in massive debt that they couldn’t immediately pay off due to the fact that the price of the digital assets has crashed, as they are wont to do.

Jim Cramer, a prominent figure in the investing scene, has come out to warn against this practice. The Mad Money host had a range of advice for investors in cryptocurrency in a new CNBC where he talks about the good, the bad, and the ugly of cryptocurrencies.

Don’t Buy Bitcoin With Borrowed Money

In a new video of CNBC’s Make It, Jim Cramer directs his advice toward young individuals that have found themselves investing in the space. He explains that there is merit in investing in cryptocurrencies, of which he holds some himself. The gains made by some in the market have been a drive for others to want to get in and make their fortune in the space. But too often, these individuals can get sucked in and end up making terrible decisions.

Cramer warns about the dangers of borrowing money to purchase crypto. Now, he is not against borrowing, as he mentions in the video, but explains that borrowing should be done for the right things. These include borrowing for a house or a car since these things are used in everyday life. However, when it comes to investing in these digital assets, it should never be done with such borrowed funds.

The Mad Money host points to the fact that cryptocurrencies are no sure bet. He refers to them as “hope securities” which he advises that he doesn’t invest in hope. Since they’re speculative assets, Cramer says to first “admit that it’s speculative.” This way, investors do not end up making the mistake of putting them in the “Proctor & Gamble” class, meaning thinking that they will continue to do well.

Hold Some Crypto In Your Portfolio

Cramer has always been vocal about his thoughts on cryptocurrencies. They have not always been bullish but he has never outrightly condemned investing in them. He admitted to owning some Ethereum which he said he got into after having to purchase some for an NFT auction. However, he continues to preach caution when engaging with such highly speculative and volatile assets.

For every portfolio, he says that investors should put 5% into gold and the other 5% into crypto. Acknowledging the possibilities of money being made in crypto, he agreed that trying to make money with cryptocurrencies is valid.

Cramer pushes further to advise that investors interested in cryptocurrencies should stick to the largest ones in the market such as Bitcoin and Ethereum. “I would never discourage you from buying crypto because of all the fortunes that have been made in it, and how it could make a whole new group of people, fortunes,” says Cramer. “I’d like that to be you,” he added.

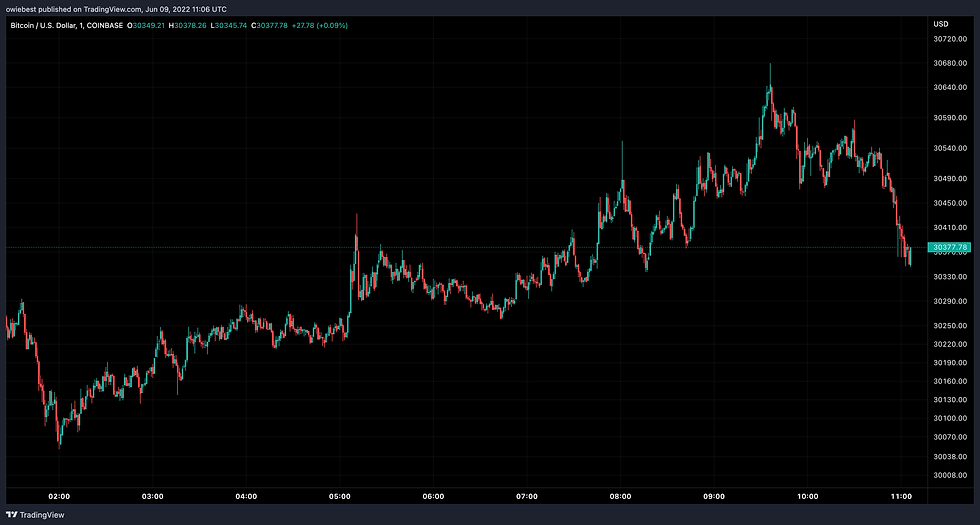

At the time of writing, Bitcoin and Ethereum continue to lead the crypto space in terms of market cap. However, the recent downtrend has since the general market dragged down to be sitting at $1.23 trillion.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Comments